A Framework For Investing And Buyouts In The Age Of Unicorns

/Unicorns are mythical animals, yet today, they are very much “real” and wholly accessible to consumers through their mobile devices. In fact, it is likely you’re using a unicorn to hail your next ride. They come in assorted flavors: some humble, some grandiose and some completely underrated (such as Zoom). When you look at Uber’s S-1 filing documents, the company has not been shy about stating how it may never make a profit. Just as well, its IPO hasn’t performed as expected. So how can investors value these unicorns as they make their public debuts? What is the proper framework for public investors and private equity firms to evaluate these companies?

In my experience, the following framework is helpful to identify, invest and manage capital:

1. Legacy brand and institutional acceptance (30% weighting)

2. Duopoly or oligopoly market structure (40% weighting)

3. Customer pain and hurdles (20% weighting)

4. Incremental versus leapfrogging innovation (10% weighting)

Legacy Brand And Institutional Acceptance

Brand equity matters. That’s my perspective, but if you examine public and private markets, within any given sector there are only a certain amount of brands that command institutional acceptance (either from a mass audience or institutional-caliber clients). Legacy brands, along with newly minted brands that have reached mass scale, that define their respective categories are immensely valuable.

Duopoly Or Oligopoly Market Structure

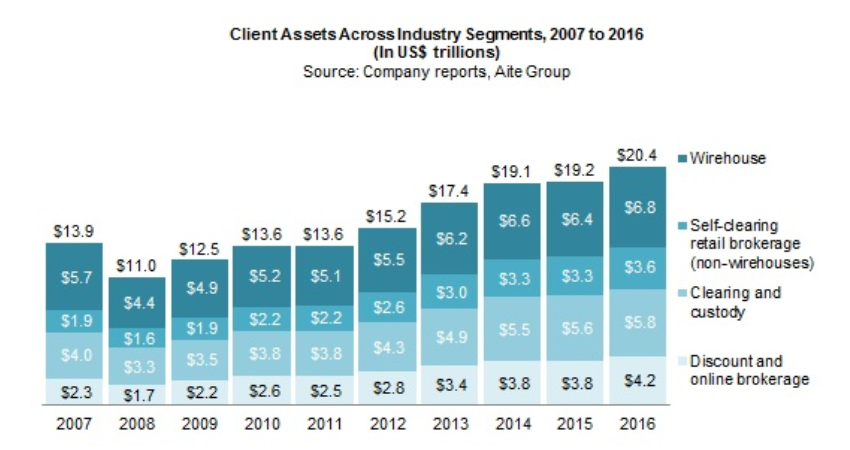

When examining industry economics, the framework provides a good amount of weighting (40%) to understanding whether a company is operating in a limited competition structure. For financial technology companies, an example of that would be back office providers (such as DST, DTCC, etc.) and for consumer goods segments, such as vitamins, an example is supplement/capsule manufacturers at scale (such as Captek or Capsugel). These economics are attractive for public investors and private equity investors due to market pricing power and the ability to release innovations that yield highly profitable returns on investment at scale.

Customer Pain And Hurdles

The framework places a 20% weighting on customer pain and hurdles. While understanding customer pain is valuable, it has less value than duopoly/oligopoly structures and established brand equity. In this framework, the best innovations and products do not necessarily win on large enterprise and institutional deals between companies. Million-dollar requests for proposals and requests for information are rife with invitations to innovative vendors to bid, but in reality (and in my personal experience), C-level executives are better motivated to bid on established legacy brands that provide “lookalike” services. Legacy brands can generally be trusted to deploy and function as intended when faced with numerous end users and have the ability to distribute, en masse, to customers without sacrificing quality.

A great case in point is Vanguard and its rollout of its robo-advisory service. Launched well after the hoopla for Wealthfront and other venture-backed robo-advisors, the company “smoked” the competition. As of 2019, Vanguard’s service has approximately $115 billion under management compared to Wealthfront and Betterment, which have about $11.5 billion and $14 billion, respectively. And the bulk of the service’s assets under management growth took place since it launched in 2015.

This is a great example of how customer pain and hurdles are secondary compared to established brand equity. Investors are seeing greater competency and capabilities of established brands to take a more aggressive approach toward a technology-based execution strategy.

Incremental And Leapfrogging Innovation

The framework places a 10% weighting on innovation (whether incremental or leapfrogging). Why? Innovation is valuable, but it is not to be confused with the ability to generate massive earnings impact and profitability that established players or established brands can deliver at scale for their customers.

For financial services, this might include the ability to deploy a service across thousands of end users without compromising security, quality and support. For consumer goods, this means immediate distribution at mass scale (having the inventory) and achieving quality control at a global level to meet market-wide demand.

For private equity investors, finding established brands that would benefit from innovation and balance sheet discipline creates the ideal situation for a value-add buyout. Investors shouldn’t discount established brands simply because of stiff competition from firms such as Amazon. Case in point: Best Buy successfully turned around a situation where “Everyone thought we were going to die,” the company’s CEO told Bloomberg last year.

1960 And 2019: Perspectives Matter

Nobody would ever consider P&G to be a unicorn. Yet back in 1960, the company exhibited all the greatest attributes of one. There are many stories within P&G’s expansive history, but I’m going to focus on the unique story of the company’s foray into paper goods as told in the book “Rising Tide.”

In 1957, P&G acquired Charmin Paper Mills, which was a regional competitor at the time. In this era, Scott Paper and Kimberly-Clark were clear market leaders. As P&G sought to introduce Charmin and Puffs, it naturally faced stiff competition. Moreover, the company found itself repeatedly underestimating the startup costs required to scale paper goods. Around 1962, it struck innovation with a process for manufacturing softer and more absorbent tissue. The process notably differentiated P&G’s paper offerings. Competitors would have required high capital costs to remodel their production processes to replicate it, and by the end of 1969, the company dominated the paper goods category. This process took nearly 12 years to fully realize market dominance. But it happened because P&G was an established legacy brand that adopted (incremental or leapfrogging) technologies and delivered superior returns.

Despite different eras, both P&G and Vanguard adopted innovation at an institutional scale and leveraged their established brand equity to bring on new customers.

Conclusions And Impacts On Private And Public Wealth

Frameworks are necessary to help guide and understand the chaotic events that unfold daily. For public investors, understanding how management, technology-based execution and brand equity can shift myopic perception issues creates opportunity. For private equity, it’s about identifying established legacy brands in the right market structure, with high growth macros and myopic management teams.