Key retirement hurdles to be concerned with and UHNW retirement problems

/Wealth management is continuously changing - regulatory reform, SEC best interest, and now Fidelity with their zero fees investment product. This is going to create revenue pressure for independent wealth management firms seeking to provide a comprehensive service. Areas to really focus on is understanding the clients household true needs rather than focusing individually just on the husband vs. wife. Notwithstanding, the statistics for retirement are both good, interesting and alarming.

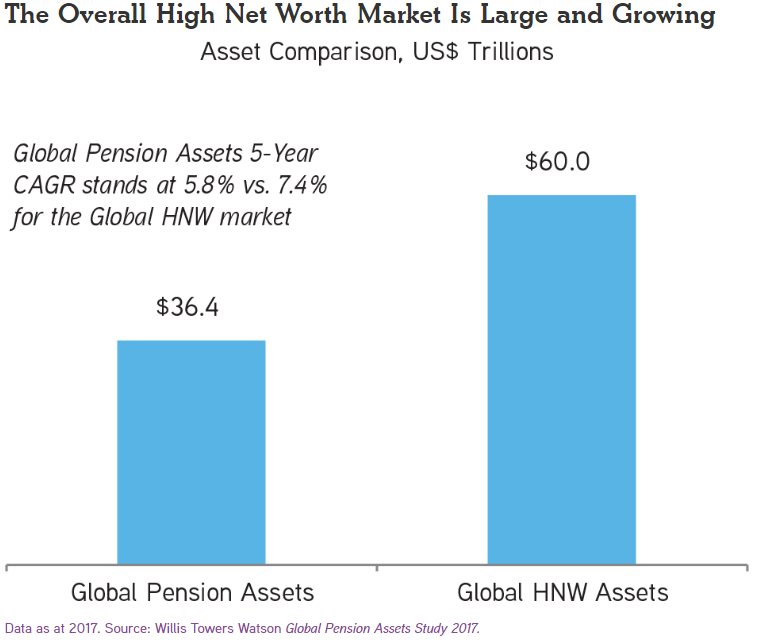

Onto the good part - the mass affluent and HNW are growing. This means the net wealth is improving - creating opportunities for wealth management and proper retirement.

In 2017, there were 31 million Mass Affluent households with a net worth between $100,000 and $1 million, not including primary residence. That is an increase of half a million households from 2016.

The number of Millionaires, those with a net worth between $1 million and $5 million, climbed to 9.98 million, an increase of almost 600,000 compared with 2016.

The Ultra High Net Worth market, in which net worth is between $5 million and $25 million, grew to 1,348,000 households, an increase of 84,000 from 2016.

There are now 172,000 households with a net worth exceeding $25 million. That reflects an increase of 16,000 households from the 2016 total, an increase of more than 10 percent from the 2016 total of 156,000.

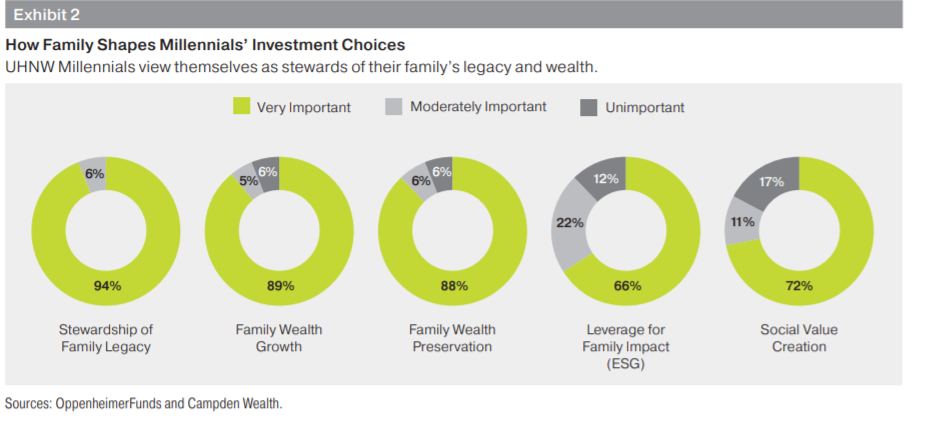

The need for conversations between the advisor with the family regarding legacy and finding the right investment model that moves across generations. We can see Exhibit 2 that the UHNW millennials view themselves as stewards of their family's legacy and wealth.

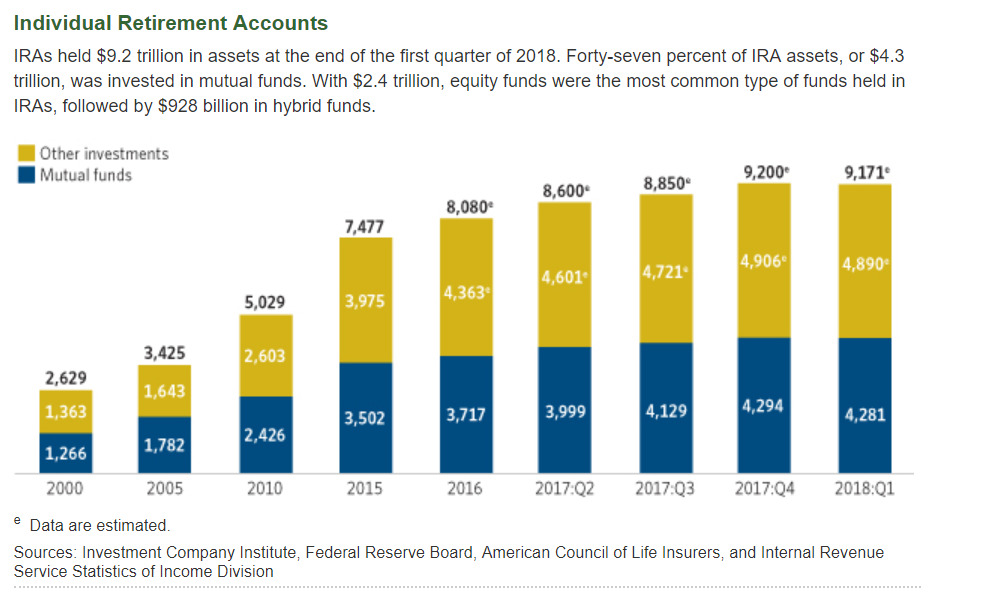

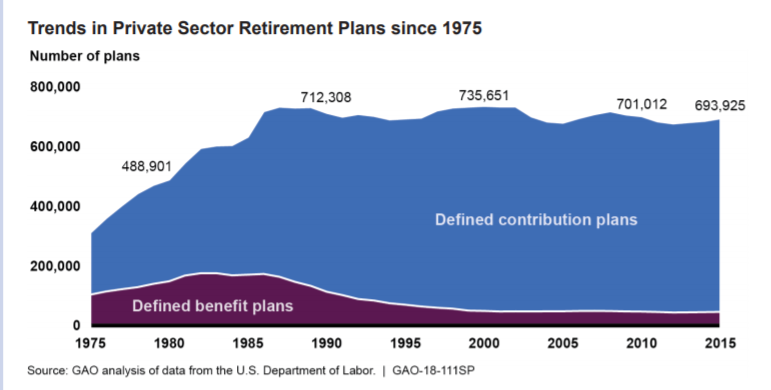

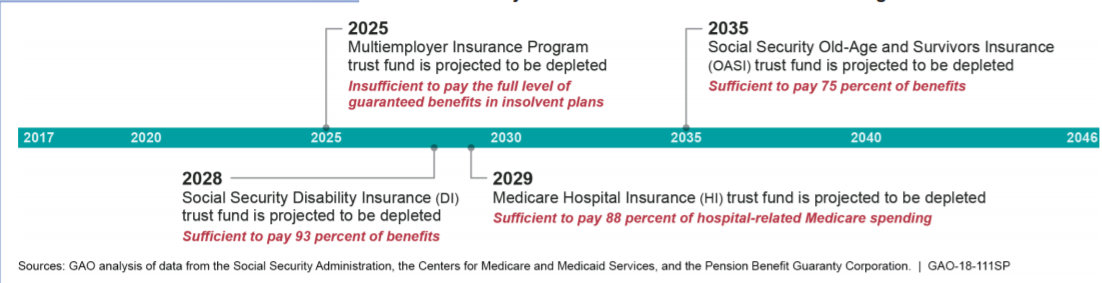

Taking a step back from the HNW/UHNW population, we begin to see individual retirement accounts continue to grow and stabilize between Q4'2017 and Q1'2018 (stronger when considered year over year change, see image below). Going into the details and investment mix among the mass affluent - we also see that defined contributions have really taken the market by storm since the transition in 1975. Harder on this is the problem with social security funds. Financial advisors need to plan for the following hits for the baby boomers:

By 2028, Social Security Disability Insurance Trust Fund is expected to be depleted

By 2025, Multiemployer Insurance Program trust fund is projected to be depleted

By 2035, Social Security Old Age and Survivors Insurance trust fund is projected to be depleted

When looking at the value proposition, and delivering best solutions for clients, advisors should focus on:

Building a comprehensive relationship and discussion approach to the existing generation and upcoming

Plan for worst case funding situations, liquidity needs and baseline lifestyle income solutions

Consider alternatives to properly hedge against inflation and geopolitical risks going forward

Segment clients based on complexity with investment, compliance and relationship/servicing work