Money At Risk: Wealth management founders are better entrepreneurs yet are hurting

/What is it like to start a business? What is it like to build something from nothing? It's grueling, difficult, and you're essentially fighting in the trenches. I've been there myself and my family has been there. My father was an immigrant and in the mid 90's founded digiTRADE Inc., one of the first online brokerage/stock trading systems in the world. We started off poor but found ourselves right in the middle of the "American dream". Movin' on up for the Jefferson's - but the Asian American version. When I started BlackCrown in 2009, it was originally a whole loan trading operation seeking to arbitrage the pricing differences between portfolios of whole loans that banks often sell to Wall Street (pre-securitization process). One thing, I had limited institutional experience selling whole loans. Through grit, street smarts, persistence, cold calling, navigating the inner workings of whole loan trading desks (and 18 months of consecutive failure), I was able to close on a transaction between Redding Bank and Deutsche Bank for $100MM.

For wealth management firms, I credit RIAs as one of the better entrepreneurs in a world where everyone wants to "start something to disrupt something". (Note: I'm a series 65 and a series 7 holder too). Independent wealth management firms start a business to leverage their entrepreneurial spirit to help families save, retire and accomplish their life goals through financial means. There is a different type of grit to calling and building new relationships and gaining the trust of families to entrust an RIA with their assets. The affect is tremendous as is the responsibility (and liability). This type of grit surpasses the grit of any young gun raising billions of venture capital to become the next Uber. In many cases, RIA's are bonafide motherfuckers that are relentless for the best reasons (fiduciary) and their impact is truly lasting.

Today, wealth management firms revenue models are being challenged. One of the key things to add value is to segment your clients beyond simply revenues and "Tier 1, Tier 2 etc.". A candid view is to segment clients based on other aspects such as demographics, race and culture. Why? Because knowing more about how a family lives can help advisers understand the liquidity crunch/needs in world of retirement (and living off of savings/portfolio returns). Just as well, the demographics for families coming out of the 2008-2009 recession implies lasting negative wealth impacts despite a rising stock market.

Consider this:

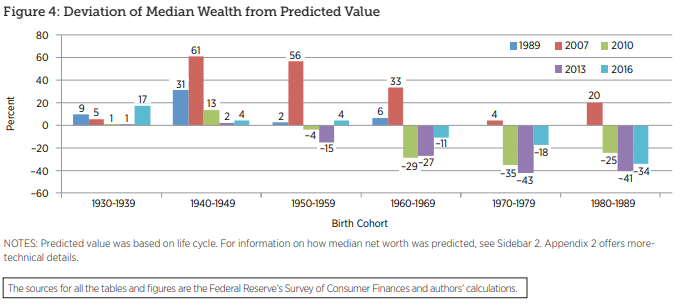

- Wealth loss occurred across the age spectrum post 2008-2009 recession

- Families younger than retirement age suffered the most and rebounded slowly

- Families headed by someone born in 1960s, 1970s, 1980s were significantly below wealth management benchmarks

- Families headed by someone born in the 1930s, 1940s, 1950s were slightly above their age specific benchmarks

- On a recent survey across 3 generations (baby boomers, gen x and millenials) - “Outliving my savings and investments” is the most frequently cited retirement fear among Generation X (57 percent) and Baby Boomer workers (55 percent), while “not being able to meet the basic financial needs of my family” is the most frequently cited fear among Millennials (47 percent).

Illustration of deviations from median wealth per generation.

Really good chart from the Transamerica Center for Retirement Studies

Astonishing is the risk for those born in the 1980s to accumulate less wealth over their life spans (excluding inheritance) than members of previous generations.

As inheritance picks up - transfer between boomer and generation x will intensify. With the vast majority of generation x turning 50-60, this leaves about 25-15 years left for retirement. This means the requirement for yield will only increase. Financial advisers should take note.

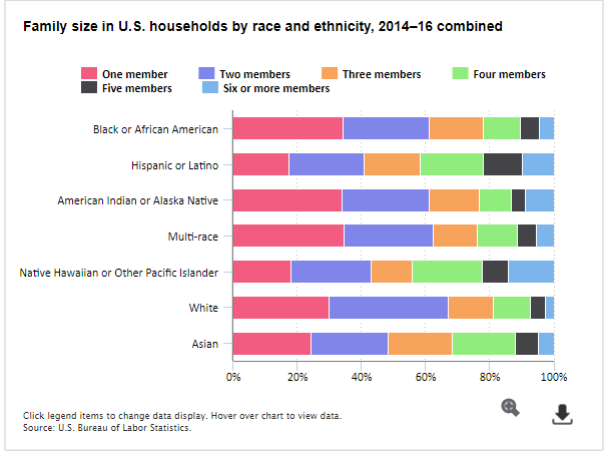

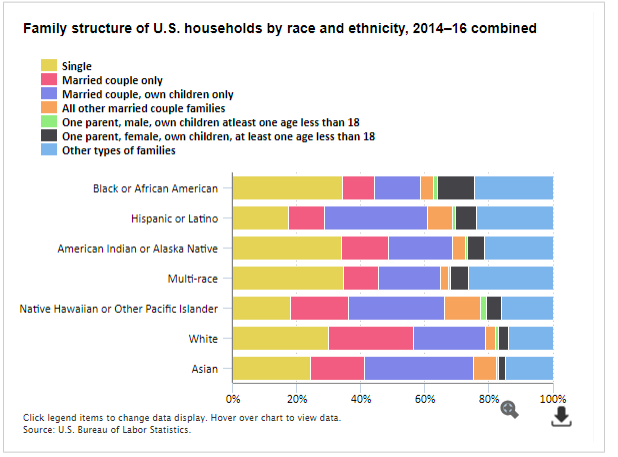

Perhaps a way to add value is to segment retirement and cash flow/liquidity planning based on individual investment policy statement + social demographics. It's candid but it offers a view in how retirement savings would be spent (statistically speaking) based on age, demographics, race and culture.

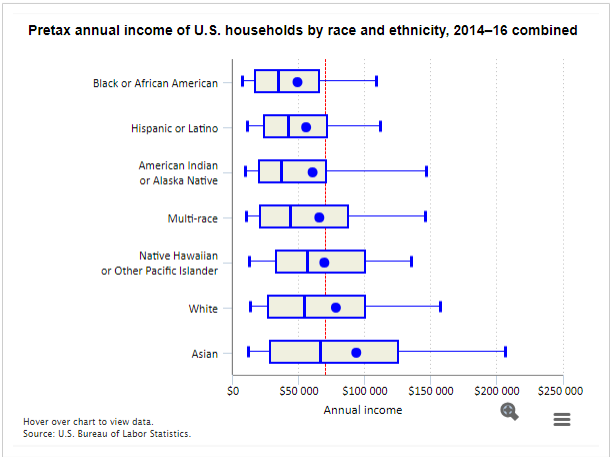

- Between 2014-2016, the average household pretax income was $70,448

- Highest was for Asians with $93,390

- Lowest for Blacks/African Americans with $48,871

- Gap between those in the lowest 10% of income and those in the highest 10% was widest for Asians and smallest for Hispanics/Blacks

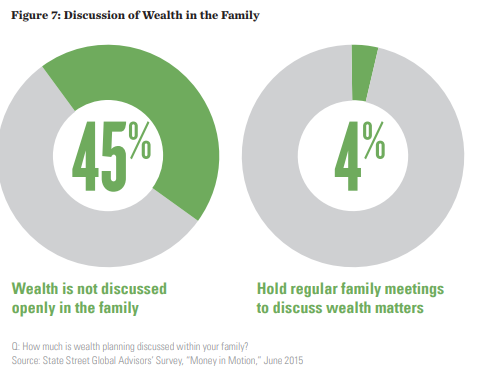

Amazingly, families just do not talk about money. This is the opening and requirement for wealth management entrepreneurs/advisers to build that conversation piece.

Sign up for our webinar, our portfolio company (AppCrown LLC) has the necessary tools to help financial advisers present their value and guide their clients to meet their retirement goals.