Money At Risk: Retirement isn't simple and issues are everywhere

/Retirement is a result of planning, frugality and self-discipline. Nevertheless, the concept of retirement plagues and and every individual across the globe. The retirement issue is not isolated to America. Let's take at the global issue with retirement and wealth management.

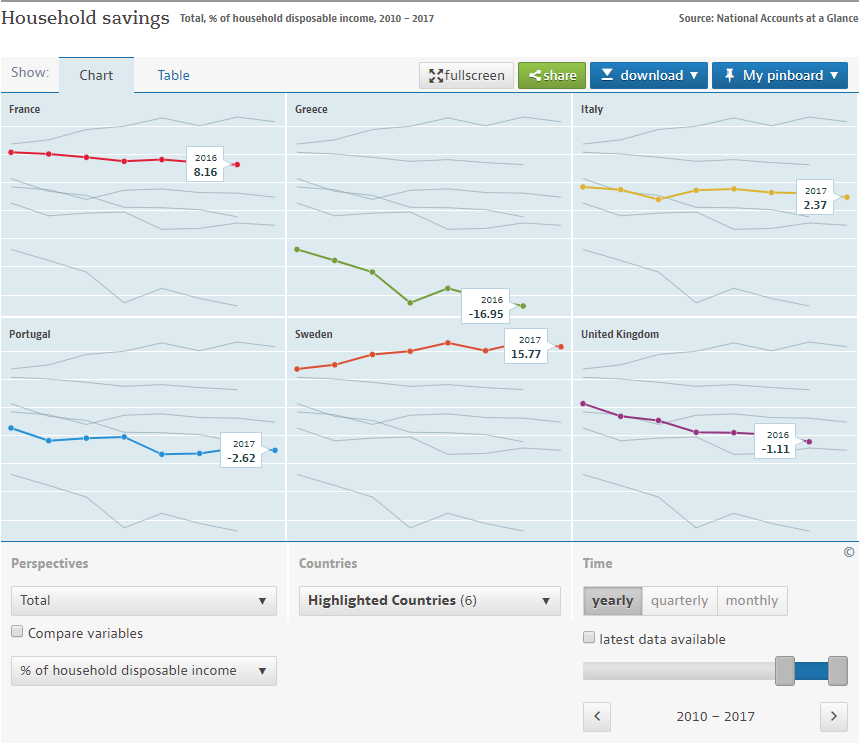

Looking at global household savings rate, we see:

- UK households are getting over leveraged

- Portugal and Greece are both in deep negative savings rates

- Italy is comparable to the US with 2.37% savings rate

- France and Sweden ebbs on the high end with Sweden taking the top country out of the entire EU bloc with 15.77% savings rate

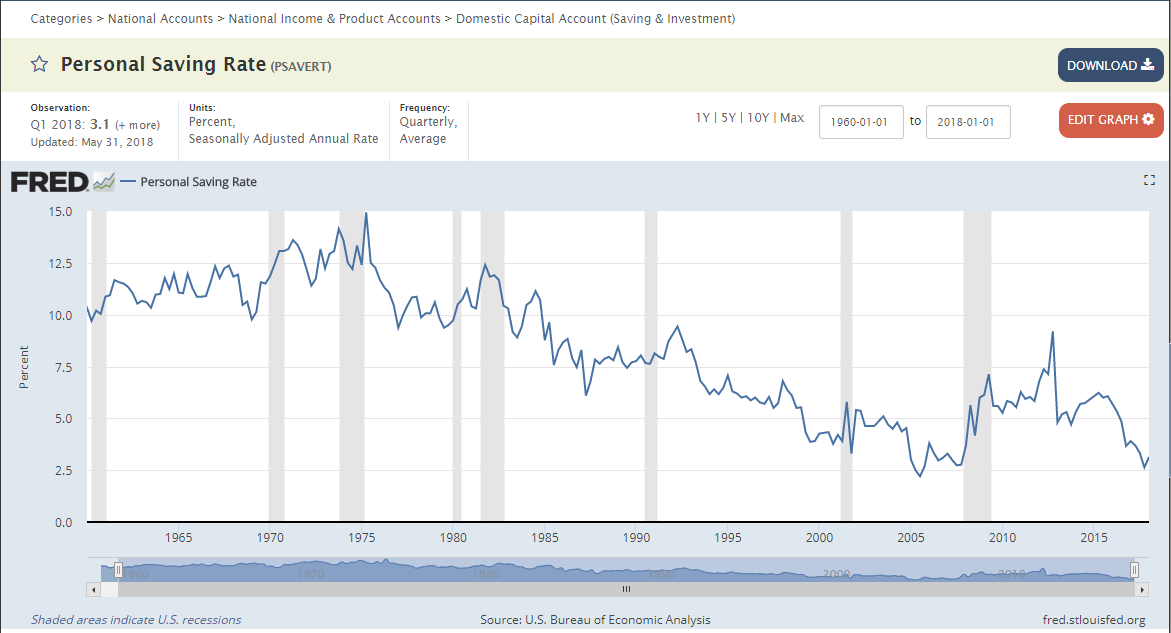

Americans save anywhere between 2.7% to 3.1% per household. Interesting enough, here are some additional facts about US household net wealth:

- On average, there is $60,200 worth of debt per household

- In 2017, mean wealth is $388,585 and median wealth is $55,876

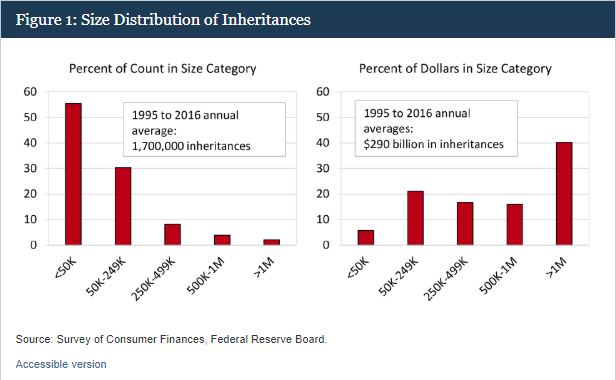

- Just as well, inheritance sizes vary and for most of the population, they average between $50,000 (usually) to $249,000. Given the statistics of households, rising healthcare costs for elderly care, and inheritance related taxes, these numbers are unlikely to make up for the retirement gap for Generation X

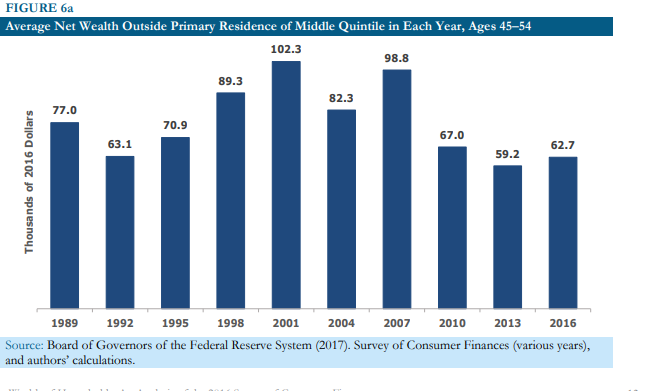

Just as well, when you begin to explore net wealth outside of one's home (primary residence), we begin to see increased probability of liquidity issues. Despite net worth being a combination of hard (real) assets with financial assets, it is the latter that pays the bills, and ensures the quality of life for retirees.

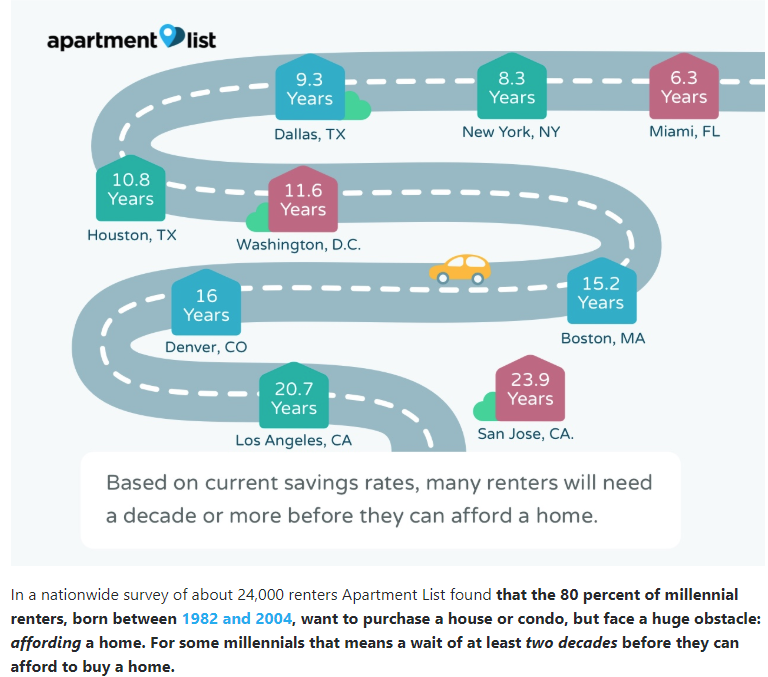

More importantly are home owners of the next generation. Many net new homeowners (those aged 25-40) will likely need to over leverage to afford that "first home". Sadly, savings rate do not support the trend and coupled with student debt (another story entirely), the odds of savings and buying a home (and thus owning real equity/net worth) becomes much less than the previous generation.

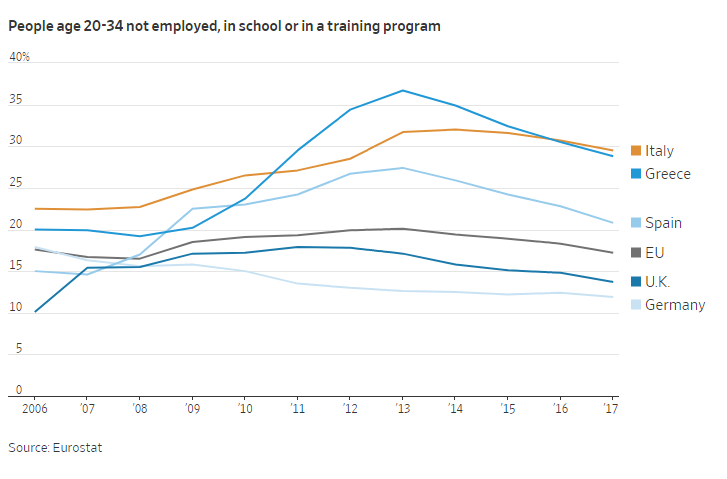

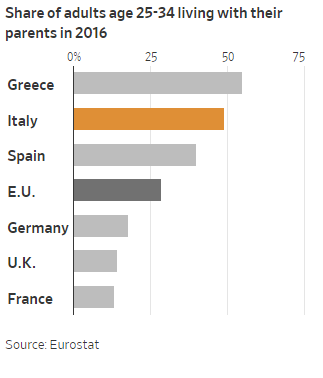

Again, the forces at play with retirement or the lack thereof also permeates to the same younger generation in Europe. Looking at the EU and across the European countries, you begin to see that savings rate coupled with difficult employment opportunities create a worse off scenario for the current and following generations.

- 17.2% of people aged 20-34 are not employed in the UK

- 28.8% in Greece

- 29.5% in Italy

What to do next:

Sign up for our webinar, our portfolio company (AppCrown LLC) has the necessary tools to help financial advisers craft the financial conversation with families and prospects, present their value and guide their clients to meet their retirement goals.